How Much Should You Save Before Moving Out?

Many teens fantasize about moving out of their parents’ homes years before they actually do. The sweet feeling of imagining your own home, where you are free to live as you please.

The big question is, how much should you save before moving out?

For the fantasy to come to life, you’ll need to find the funds to actually move out, hopefully you’ve been saving. However, it is difficult to determine the costs of moving out of parents’ house.

We’ve got you covered: here is our guide to how much you should save before moving out.

What are your Needs?

Moving out for the first time is a big step. The typical standard to stick to before moving is to have 3 months’ worth of expenses available.

As a result, you’re going to have to find out exactly what you need to spend to know what those “expenses” will be. These are only some of the expenses you’re going to have to consider, according to your needs.

You may not need to consider some of these costs – for example, if you don’t have a car, swap out a gas budget for public transportation from your new location to your school/work.

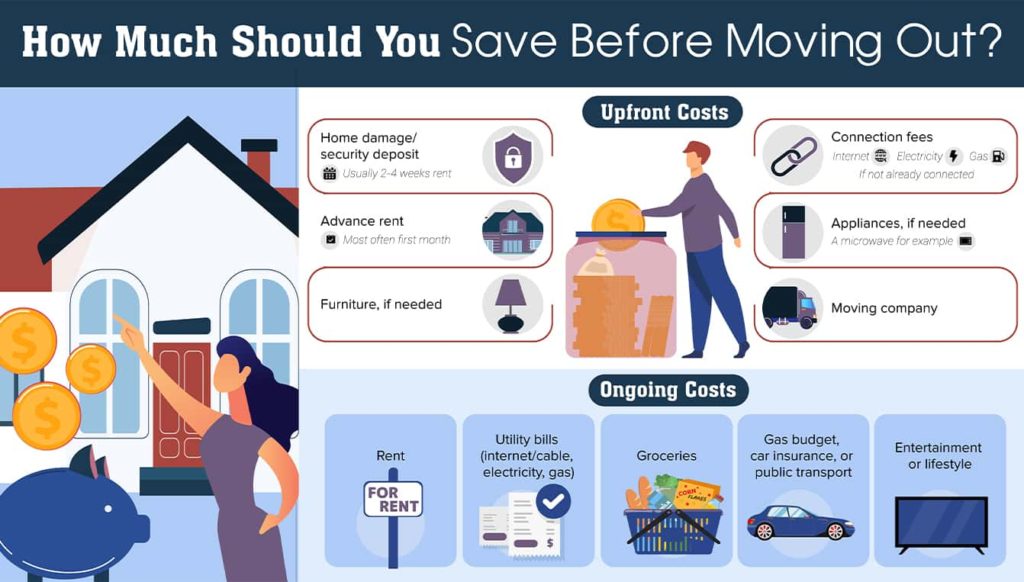

Let’s separate the costs into two categories: upfront costs, which you’ll need to pay upon arrival, and ongoing costs, which you should factor into the three following months.

Upfront Costs

- Home damage/security deposit (usually 2-4 weeks rent)

- Advance rent (most often first month)

- Connection fees (internet, electricity, gas- if not already connected)

- Furniture, if needed

- Appliances, if needed (a microwave for example)

- Moving company

Ongoing Costs

- Rent

- Utility bills (internet/cable, electricity, gas)

- Groceries

- Gas budget, car insurance, or public transport

- Entertainment or lifestyle

How Much Will the Move Cost?

In an ideal world, people would be able to move all their belongings and furniture to new homes without any help.

However, realistically, moving without help is extremely difficult. Depending on how far your new location is from your parents’ house, and the size of your new home, you’re going to need a big enough vehicle to carry everything needed.

And yes, you’re probably going to make more than one trip which is why you’ll probably need to hire a moving company.

It costs $400 on average to move into a studio apartment with the help of movers. If your new place has more than one room, count $200 for every extra room.

Tip: rent a truck and ask friends for help to save money on a moving company. Some companies that you can rent a truck from include: uhaul, budget, and enterprise.

You’re also going to need to furnish your new home. Even if you’re lucky and you can rent a furnished apartment, or your family has extra furniture they can lend you, the cost of equipment when moving out is very often overlooked.

You’re going to want to make your new place look nice, to feel at home and therefore purchase some cool decor and comfortable furniture. Only including essentials, it costs around $3000 to furnish an apartment from scratch. That is a lot of money to add onto a deposit, rent, movers, bills…

You can save some costs by looking for previously used items on marketplaces such as Facebook and Craigslist.

Cost of your move-in day expenses: From $400 if you just need to hire movers to $3000 if you have to buy furniture and equipment.

Paying your Rent

To be safe, you should allocate ⅓ of your money every month to paying your rent. However, most times before you even sign your lease, there are a lot more expenses to consider.

You could have to pay:

- An application fee, up to $100

- A background check fee, $35 to $75

- A credit check fee, $20 to $50

- A security deposit, from half to double one month’s rent

- First and possibly last months’ rent

- Move-in fees, of a variable rate

- Pet fees, if you have any furry friends you want to bring with you.

The average price of rent can get pretty high. Especially if you want to move to a big city, you’re going to have to be prepared to allocate a lot of money to your rent every month.

Let’s look at the average rent for a one-bedroom apartment in some big US and Canadian cities.

Average Rent for 1 Bedroom Apartment

| City | Average 1-Bedroom Rent |

| Montreal | $1668 |

| Boston, MA | $2900 |

| Toronto | $2099 |

| Los Angeles, CA | $3215 |

| New York, NY | $4328 |

| Ottawa | $1948 |

| San Francisco, CA | $3767 |

| Calgary | $1579 |

| Vancouver | $2100 |

Consider a Roommate

It might be a good option for you to share that rent with a roommate, or several. Find some friends that are looking to move into the same area as you and look for an apartment that can accommodate your group, which can really cut down on costs!

It’s much cheaper to get 1 bigger apartment and share it between two people than 2 smaller ones for each person.

Cost of your first months’ rent expenses: Rent + fees = ⅓ of your budget.

Utilities and Bills

As soon as you move in, you’re going to have to start paying some of your monthly bills. These can be your electric bill to run your heat, especially if you’re planning a winter move, air conditioning if it’s the middle of summer, running your kitchen appliances, and your water for hot showers.

You can expect to pay between $125 and $175 a month in basic utilities.

If you move into a strata unit such as a condo or townhome, some of these expenses may already be fixed into your rent. Know in advance what you are responsible to pay for.

There are also additional optional but useful costs, like Wi-Fi, Cable TV, and streaming services. The good thing about these expenses is you can move in and deal with them later. Make sure you can handle your basic expenses before getting fancy with Netflix and Internet.

Lastly, factor in the unexpected extra expenses if needed, like:

- Public transportation card (A New York MTA Metrocard for example, costs $151 a month, a Vancouver Compass card is $181) or gas costs for your daily trips

- $200-400 per month for food – eating out or groceries

- Weekly laundry, if you don’t have a washing machine

- Renters insurance

- Expenses like health and home fixes

- Entertainment and Social Life

Cost of your monthly utilities and bills: $500 on average.

Considering a Pet?

Adding a pet to your move can not only increase the cost of your move but it can also be harder to find the place you love. Having a pet will most likely increase the amount of money you will need to provide upfront as a damage deposit, due to potential damage a pet may cause (ex. pee on carpets, chewing, etc).

Having a pet may also hinder your ability to choose your new home as some landlords would prefer not to have a pet on their property. Whether it’s stated or not, this can be a factor in the application process.

We all love furry friends, but when moving out for the first time, know that they can be a factor.

Better Safe than Sorry

As you may have understood by now, moving out may cost more than you think. It takes a lot of planning and savings. You don’t want to risk having to move back with your parents because you weren’t able to afford to live on your own!

So, how much should you save before moving out? Understanding the costs of moving out of your parents’ house are important in determining how successful your new journey will be.

A good rule of thumb is to have 3-4 months of total monthly expenses available before moving out. With sufficient planning, you might be able to save and cut corners where you can…

Total cost of moving out: Movers + furniture + equipment + rent + fees + monthly utilities and bills.

All costs in CAD

By: Robert Puharich | August 30, 2021 |