How Does Compound Interest Work?

Learning about investing can be tedious and hard, especially as a teen or beginner, but one lesson you should learn early is that you want compounding interest to work for you and not against you.

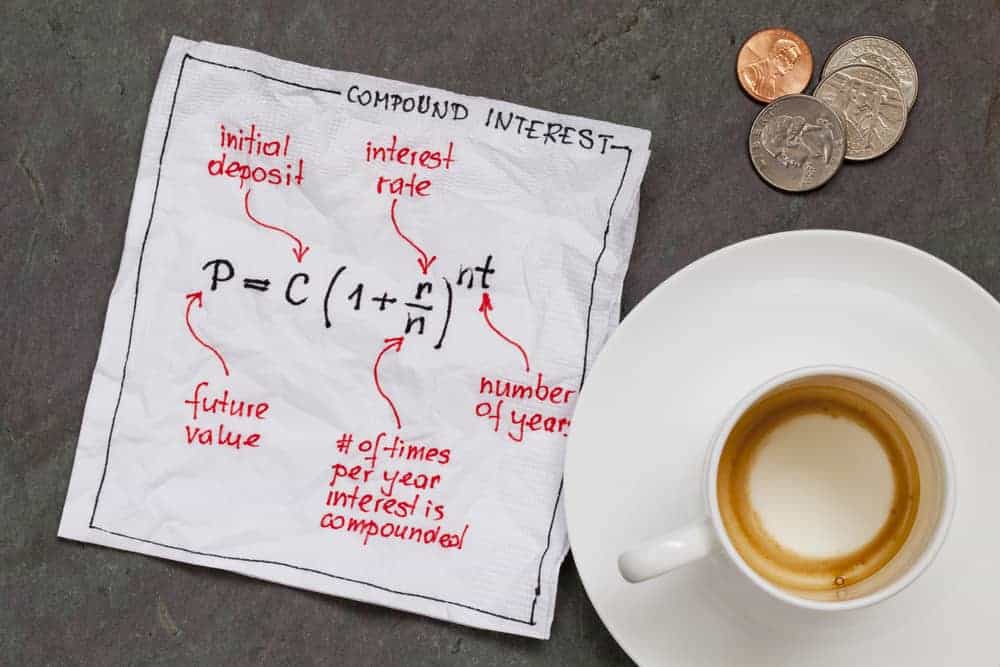

Compound interest is when the interest you earn on your investment is added to the principal amount (your original amount invested) to be reinvested (put back into the fund) rather than paid out to you.

What this means is that interest (money you are paid from a bank for investing with them) is added on top of your original investment amount. Essentially it’s interest on interest, which is a win and more so over the long term.

How you Benefit from Compound Interest

Here’s an example of compounding interest working for you with simple numbers. Let’s say you invest $100 into a fund that pays 10% interest annually.

At the end of year one you will have earned $10 in interest (yes, free money). This means that you now have $110, not only the $100 you initially invested.

Now in the second year you are investing $110. At the end of the second year you will have $121. The idea is to keep reinvesting at the end of every year

After 25 years your initial $100 investment would be worth $1,083.47. You would have earned $983.47 for making the initial investment. As time goes on your amount earned goes up.

For these returns to happen, the investment money would need to go into a fund that generates high interest. A financial advisor is a good resource to find high-paying funds. However, these high return funds also come with the risk of declining quickly.

A 10% interest rate is very generous and may not be achievable over the course of the long term for everybody but is a simple number for demonstration purposes.

Monthly Contribution to Compound Interest

To see more success with compounding interest, ideally you’ll want to keep adding to the principal amount as time goes on.

For example, rather than just leaving the $100 initial investment to grow on its own, it’s better practice to contribute more money regularly to that amount. A monthly savings plan is best which would involve contributing every month to your investment.

A good way to start saving as a teen is to simply try to save $1 a day to build up your contribution at least until you can afford more. At the end of every month you would have an average of an extra $30 to add to your total amount invested.

At the end of every year if you save $1 per day you would have contributed an extra $365 to your initial $100 investment and collected interest along the way. The compound interest formula would work on that new amount.

If you continued to do this for 50 years at an interest rate of 7% (a more realistic number) you would have accumulated $153,934.17 CAD!!!

An important note is that the interest rate will depend on the investment you choose and most will fluctuate over time. Some options to invest your money are into the stock market and mutual funds but definitely get some professional advice prior to making any investments.

Compound Interest Calculator

Try out some of your own numbers by using our Teen Learner compound interest calculator. To get an idea of how your income would look if you contributed monthly, try this compound interest calculator with monthly contributions, demonstrated with a graph. Fill in different numbers to get an idea of how much money you will need to invest to get to your goals. Of course, don’t forget to set goals.

Getting Rich with Compounding Interest

Using compound interest to build wealth is the key to many successful people’s riches.

Warren Buffet, one of the richest people in the world has stated “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

And then there’s a famous quote from Albert Einstein, “Compound interest is the eighth wonder of the world,” Einstein reportedly said. “He who understands it, earns it. He who doesn’t, pays it.”

Start Investing Young and Enjoy Later

The power of compound interest can be life-changing for an early investor and you’ll want to use it to your advantage by starting as early as you can. Compound interest can work against you in debt so you’ll want to pay your bills on time.

If you start collecting compound interest as early as 18 you have the opportunity to compound the interest for a long period, setting you up for a bright retirement. As your income goes up your opportunity to contribute more also increases.

Although this is not a get rich quick concept, you’ll thank yourself later in life.

By Robert | May 8, 2021 |